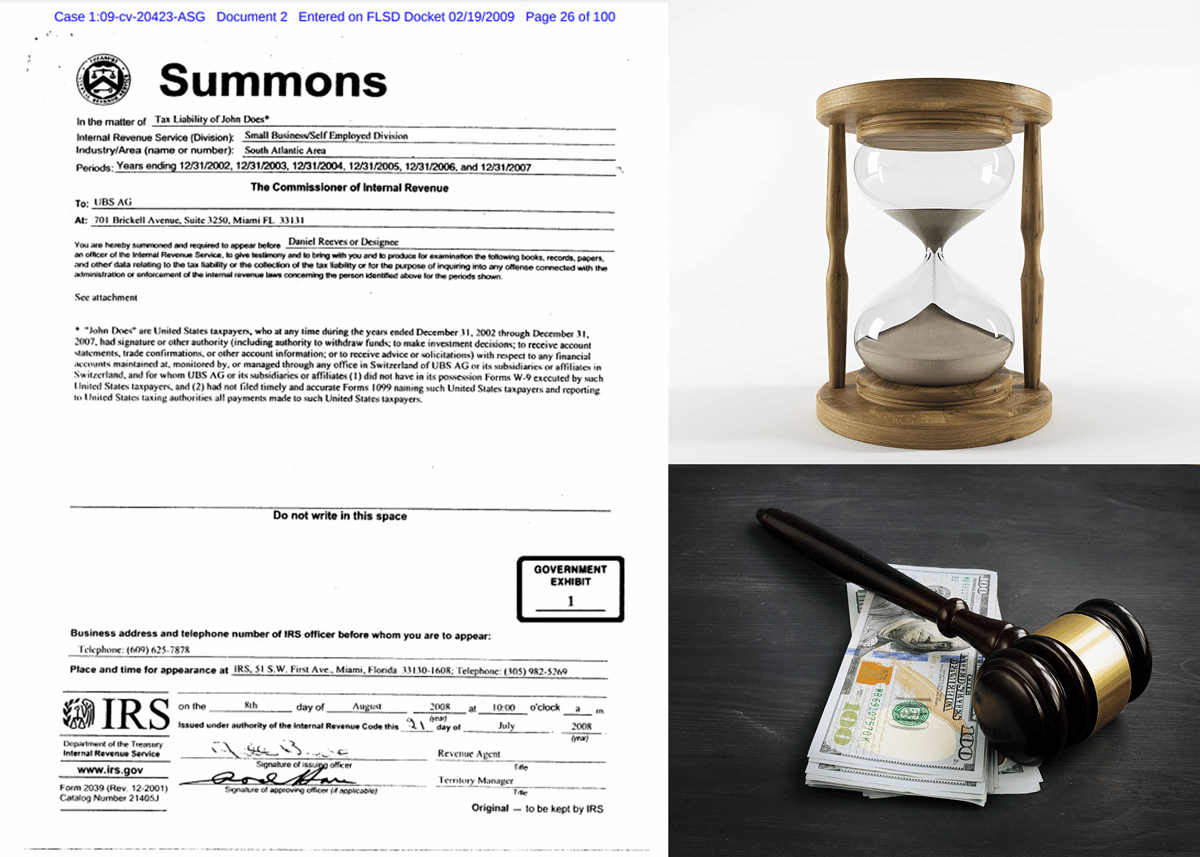

Failure to File International Information Forms Allows IRS to Assess Taxpayer More Than Five Years Past Normal Statute of Limitations

The Fairbank case demonstrates the power of IRC § 6501(c)(8) to provide the IRS the ability to assess taxpayers many years after the normal statute of limitations is closed if the taxpayer fails to file all required IRS international information reporting forms. In Fairbank v Commissioner, T.C. Memo. 2023-19, the IRS argued that, despite the…