Maryland Tax Attorney & CPA

I Resolve Tax Issues

Practice Dedicated to Resolving Federal and State Tax Issues

My services can be understood in terms of the desired outcome:

- preventing increased tax debts (IRS and state tax examinations, appeals, Tax Court),

- bringing taxpayers into current compliance (filing past due returns, voluntary disclosures),

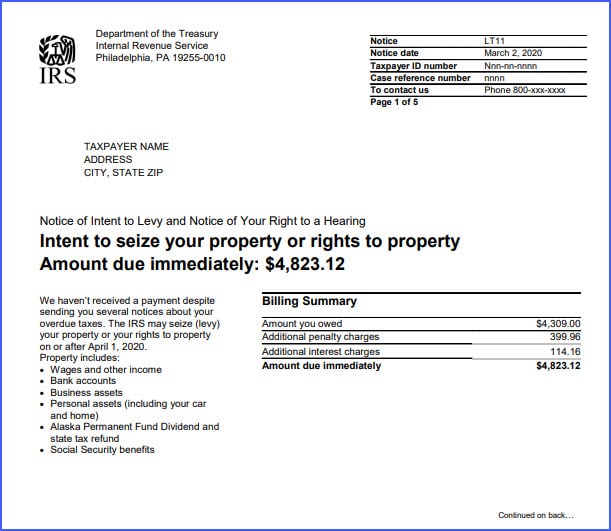

- avoiding enforced collection action (seizure of assets (i.e., levies)),

- managing existing tax debts through collection alternatives (Installment Agreements, Offers in Compromise – Doubt as To Collectability, CNC), and

- challenging existing tax debts (OIC- Doubt As To Liability, Audit Recon, MD Late Appeal).

Most Common Practice Areas

IRS Audit & Appeals

If you are the subject of an IRS examination, I can represent you. I can alleviate your stress by advocating on your behalf to obtain a favorable result. If you received an unfavorable determination in an exam, I can help you challenge

IRS & State Tax Collections

Collection alternatives are determined based upon your ability to pay, which is calculated under complex administrative guidelines. If you owe the IRS or the state, I can help you understand your alternatives to manage your tax debt and avoid enforced collection actions.

Trust Fund Recovery Penalty

If you own or if you are employed by a business that has fallen behind in remitting payroll taxes, I can defend you against IRS or state determinations that you are personally liable for these unpaid payroll taxes.

Offers In Compromise

If you or your business owe the IRS or the state, I can assist you seek a reduction of your tax liability through administrative guidelines meant to give taxpayers a fresh start.

Unfiled Returns

If you have fallen behind in your income tax filing obligations, then I can help you come into compliance by filing past due returns.

MD License Hold

If the state has a hold on your license or tag, I can help you get the hold lifted by working with the state taxing authority.

For a list of all Services

Justin Hughes

JD, CPA, LLM

Justin Hughes holds a Juris Doctor from Case Western Reserve University School of Law and an LL.M. in Taxation from New York University School of Law.

Justin started his professional career in 1999 at a CPA firm in his hometown, State College, PA. Prior to moving to Maryland, Justin worked in Manhattan as a senior manager in the M&A tax consulting group of one of the Big 4 accounting firms. Justin has provided tax advice to individuals and businesses of all sizes, including small family businesses up to Fortune 100 companies.

Since moving to Maryland, Justin has used his experience in accounting and study of law to understand and advocate for small and medium sized businesses in tax examinations, appeals, collections, and Tax Court. In addition, he has successfully helped clients obtain IRS private letter rulings.

FAQ

Let’s Discuss Your Path Towards Resolution

Dealing with the IRS and state taxing authorities by yourself can be stressful. Cases involve both tax procedures and substantive tax law. As an attorney and CPA, I can help you navigate the process and advocate for the best resolution based upon your facts and circumstances.