D.C. Circuit Upholds Tax Court Decision That John Doe Summons Precluded Qualified Amended Return

The Lamprecht case is a good reminder of how long and complex the path can be for international taxpayers to correct prior wrongs and come into compliance for federal income tax purposes.

On April 23, 2024, in Lamprecht v Commissioner, ___ F.4th ___ (D.C. Cir. 4/23/24), ( D.C. Circuit Court opinion) the U.S. Court of Appeals for the D.C. Circuit upheld the Tax Court’s decision that a John Doe summons held the statute of limitations open on a taxpayer’s individual returns for several years past the normal lapse date. This allowed the IRS to add 20% accuracy-related penalties during an IRS examination, even though the taxpayer had already filed amended returns and paid the tax years before.

Generally, when a taxpayer files an amended return to correct an issue, the amended return will not result in accuracy-related penalties if it is considered a “qualified amended return”. However, there are several circumstances that will prevent such an amended return from being “qualified.”

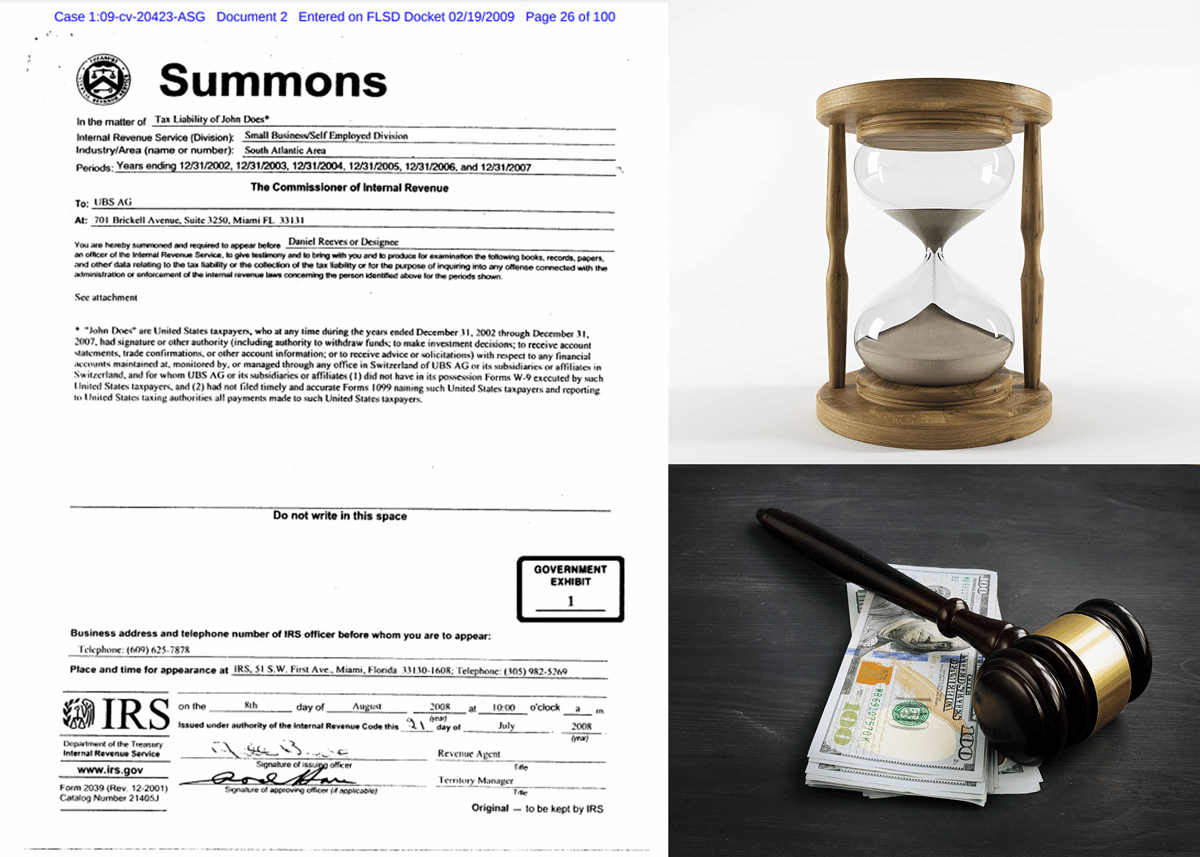

One such circumstance is if the amended return is filed after “the IRS serves a summons . . . relating to the tax liability of a person, group, or class that includes the taxpayer . . . with respect to an activity for which the taxpayer claimed any tax benefit on the return directly or indirectly.” 26 C.F.R. §1.6664-2(c)(3)(i)(D)(1).

I discussed the Tax Court decision in more detail here: John Doe Summons Extended SOL & Prevented Amended Returns From Fending Off IRS Penalties

On appeal, the taxpayer continued to attack the validity of the summons, the date upon which the summons was satisfied for proposes of calculating the statute of limitations, and whether the summons actually holds the statutes open under the regulation (i.e., were all of the criteria met).

The D.C. Circuit was not persuaded by any of the taxpayers’ arguments, so it affirmed the Tax Court’s decision. The Circuit Court’s opinion dealt with the taxpayers’ argument succinctly. As the opinion noted, the taxpayer’s amended returns were filed after a John Doe Summons sought information on “a class of taxpayers who did exactly what the Lamprechts did — use UBS accounts to underreport their taxable income.” As a result, the taxpayer’s amended returns were not “qualified” because of the IRS’s John Doe summons issued to UBS.

The key takeaway is that taxpayers with an international footprint must be cautious and navigate a number of complex provisions when coming into compliance. Filing amended returns before the IRS opens an examination is not always enough to ward off penalties from errors and omissions on an original return.