Overview of IRS’s Voluntary Disclosure Practice (VDP)

Voluntary compliance is the cornerstone of our federal income tax system. Taxpayers that attempt to comply in good faith can be civilly penalized for their mistakes but are generally spared from criminal prosecution. Criminal prosecution is generally reserved for taxpayers that “willfully” defeat or attempt to defeat their tax and tax-related obligations.

The IRS Voluntary Disclosure Practice (“VDP”) is an avenue for a taxpayer that has willfully failed to comply with tax or tax-related obligations to come into compliance. This includes a criminally “willful” failure to report foreign financial assets on information returns, including a Report of Foreign Bank and Financial Accounts (FBAR)(FinCEN 114). However, the IRS’s VDP is not available to taxpayers with illegal source income.

In order to enter the VDP, a taxpayer must make a timely disclosure, must cooperate fully with the IRS, and must pay the resulting tax, penalties, and interest in full. In some circumstances, the taxpayer may pay through a full-pay installment. Full cooperation includes providing the IRS with amended tax returns and supporting documentation for the disclosure period. Generally, the disclosure period is a six-year period. The amended returns in the disclosure period are then subjected to a full IRS field examination.

The IRS VDP provides for a set penalty structure, which generally requires the imposition of a civil fraud penalty (75%) on the tax year with the highest tax correction in the disclosure period. If a taxpayer discloses unreported foreign financial accounts, then the IRS imposes willful failure to file penalties (i.e., 50% of the highest aggregate balance within the disclosure period).

In return for successful completion of the program, the IRS will enter into a closing agreement that agrees to resolve the disclosed issues civilly. However, the IRS does guarantee that a voluntary disclosure will automatically guarantee the taxpayer immunity from prosecution. However, typically, the IRS will not recommend the taxpayer for prosecution if the taxpayer cooperates fully, in good faith, and makes arrangements to full pay the resulting tax, penalties, and interest.

In the sections below, this post will discuss the VDP’s key concepts (i.e., timeliness; full cooperation, etc.), the steps in the VDP, and other important issues to consider before entering the IRS’ VDP.

History & Authority for VDP

Prosecutions in tax and non-tax cases tend to become weaker when the defendant comes forward of their own volition to express remorse and to show a willingness to accept the consequences of their previous actions. The VD program subtly accepts this fact by allowing those who engage in it, in most instances, to escape criminal exposure.

The IRS has had a voluntary disclosure policy in one form or another for over 100 years. The program has always been an administrative program that is not formalized in statute or regulations.

The most recent overhaul of the VDP took place in 2018 after the IRS ended its Offshore Voluntary Disclosure Program (OVDP). In November 2018, the IRS issued a memo announcing the merger of offshore disclosures into pre-existing domestic voluntary disclosure “practice” for those taxpayers with criminal tax culpability. Since the November 2018 memo, the current VDP encompasses both disclosures related to domestic and offshore tax related activities.

General Principals

Although every new IRS commissioner has the opportunity to limit, expand, or modify the terms of the program, the program has several key principals that have stood the test of time.

First and foremost, the disclosure must be timely. That is a taxpayer can only make a voluntary disclosure if they IRS has not already opened an investigation into the to taxpayer or into a related concern that will likely lead to the discovery of the conduct to be disclosed. If the IRS is already investigating the taxpayer, then a disclosure cannot be made because it is not timely. To enter the program, a taxpayer must be “precleared” by IRS CI by providing identifying information to be used by IRS CI to check for data in their files.

Second, the taxpayer must fully cooperate in good faith with the IRS until completion. As discussed below, the years in the disclosure period are subject to standard IRS examination procedures. However, once a taxpayer enters the program, revocation is at the discretion of the Service. A taxpayer cannot request to stop the process or otherwise opt out.

Third, the IRS expects that the taxpayer will pay in full the resulting tax, penalties, and interest at the close of the program. While the program contemplates the possibility of a collection alternative, it is not the norm. The IRS currently demands during the preclearance process that the taxpayer affirm the ability to full pay the projected liability.

Finally, the IRS does not guarantee that a participant will not be prosecuted. Rather, a voluntary disclosure will be considered along with all other factors in determining whether criminal prosecution will be recommended.. Practically, the IRS does not refer a taxpayer for prosecution if the taxpayer fully cooperates, signs the closing agreement, and pays the resulting liability.

Who can participate?

The instructions to the preclearance form (i.e., Form 14457) provides that all types of taxpayers, including individuals (U.S. Citizens, Green Card Holders, expatriates, non-resident aliens), business entities (e.g., corporations, partnerships, LLCs, trusts), and estates can utilize the program.

However, as stated above, the program is designed for taxpayers who have willfully failed to comply with tax or tax related obligations. The IRS website urges taxpayers that have made an non-willful error or mistake to consider other options.

The program is not available for taxpayers with illegal sources of income. Whether a source is illegal is made at the federal level. Therefore, activities determined to be legal under state law but illegal under federal law are considered illegal for purposes of the VDP (e.g., income from marijuana).

Another notable exception, although increasingly less applicable due to the passage of time, is that taxpayers who participated in the OVDP are not eligible to use the VDP program if the disclosure periods overlap.

Scope of Disclosure

As of November 2018, the Voluntary Disclosure program merged the domestic and offshore voluntary disclosure programs. Again, the program is designed for willful non-compliance, including willful failure to file FBARs. However, those seeking to correct non-willful errors or omissions can potentially file amended returns or seek to come into compliance through the Streamlined Domestic Offshore Program (SDOP). In addition, the program contemplates the disclosure of willful non-compliance with respect to digital assets such

Typically, the “disclosure period” is the most recent six tax years for which the due date has already passed. This is true even if the willful noncompliance spanned more than 6 tax years. The disclosure period measurement date is based on the received date of Form 14457, Part II, Voluntary Disclosure.

In cases where noncompliance involves fewer than the most recent six tax years, the voluntary disclosure must correct noncompliance for all tax periods involved.

On the other hand, if a taxpayer had their preliminary acceptance revoked, the taxpayer can no longer benefit from the limited six-year scope of the VDP. In this case, the examiner has discretion to expand the scope of the examination. Fortunately, internal IRS guidance released through a FOIA request indicates that revocation of preliminary acceptance should be rare. The internal IRS Guidance indicates that revocation may be based upon lack of cooperation, but the revenue agent should provide fair warning of perceived non-cooperation, and the taxpayer can seek review of the decision with the IRS Territory Manager.

Steps before Entering VDP

It should be noted that entering the VDP is a significant commitment and failing to complete a disclosure successfully can have serious negative consequences. Therefore, before initiating a voluntary disclosure, a taxpayer needs to seek out professional advice.

Unfortunately, communications with a tax professional (i.e., CPA, EA, etc) regarding criminal tax matters are not privileged and such advisors can be compelled to testify against their client. Given that the conduct at the heart of a potential disclosure is willful non-compliance (i.e., potentially criminal tax conduct), taxpayers must be careful in what they share with their general tax advisor.

However, a taxpayer considering a voluntary disclosure should be fully candid with their advisor. Therefore, a taxpayer should speak with an attorney because communications with an attorney are subject to the attorney-client privilege.

Although accountants are typically involved in voluntary disclosures, they are hired by the attorney under a Kovel agreement. Under the Kovel agreement, the accountant is acting as an agent of the attorney to assist with the attorney’s provision of legal advice. This brings the relationship and communications with the accountant under the umbrella of the attorney-client relationship. Ultimately, privilege may be waived when the disclosure is made, but it is important to protect the communications at least until the taxpayer makes an informed decision.

Steps in VDP

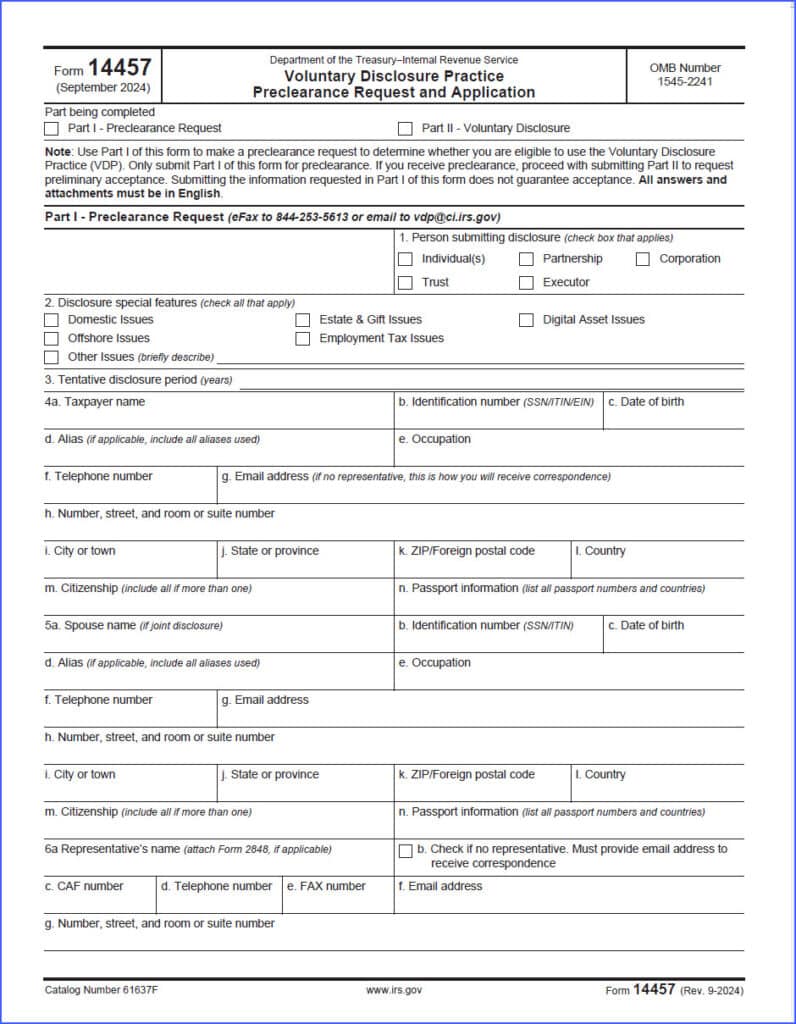

The IRS uses Form 14457 Parts I and II to screen requests to enter the VDP program. The information required on Form 14457 Part I allows IRS CI confirm that the VDP request is timely, and Part II allows IRS CI to review the substance of the disclosure to confirm that the taxpayer meets the VDP’s criteria.

Form 14457, Part I

Generally, a taxpayer initiates a potential voluntary disclosure by filing Part I of Form 14457, Voluntary Disclosure Practice, Preclearance Request and Application. Part 1 is designed to allow IRS CI to confirm that the disclosure is timely. That is, the taxpayer supplies information so that IRC CI can confirm that it has not begun an investigation into the taxpayer or the conduct to be disclosed.

Part I of Form 14457 requests identifying information for the taxpayer, any related entities, and any bank accounts involved in the willful conduct to be disclosed. The form also provides checks to alert IRS CI to the “special features” of the disclosure (i.e., Domestic Issues, Foreign Issue, Digital Asset Issues, etc). The form also asks questions a variety of questions to confirm that the taxpayer is eligible (i.e., has the taxpayer been investigated by the IRS Civil or CI; does the taxpayer or related entities have illegal source income; etc).

Unlike Part II, Part I of Form 14457 can be filed by the taxpayer’s power of attorney, and it does not need to be signed by the taxpayer

The IRS may take up to 45 days to review their files before replying to the taxpayer. IRS CI will then send a letter confirming that the taxpayer has been precleared to make a disclosure. The letter states that the taxpayer has 45 days from the date of the precleareance letter to submit Form 14457 Part II.

The complete Form 14457, including the IRS’s form instructions, can be found here: https://www.irs.gov/pub/irs-pdf/f14457.pdf

Form 14457, Part II

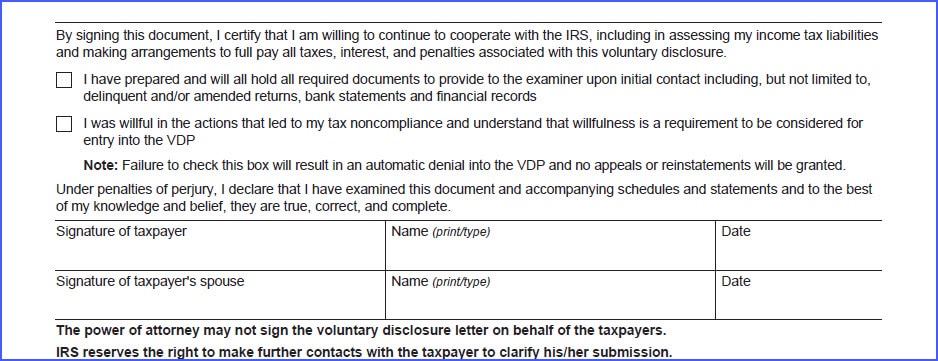

Submitting Part II is a momentous step because Part II requires a significant amount of detail regarding the willful conduct being disclosed. In addition, when signing the Part II signature block, the taxpayer is declaring under penalties of perjury that they have reviewed the document and any accompanying materials, and that the information is “true, correct, and complete.” Misrepresentations or omissions can lead to serious legal consequences, including invalidating the disclosure and exposing the taxpayer to civil or criminal penalties.

Part II requests additional information about the taxpayer’s conduct, including the estimated unreported income and/or overstated deductions, names of advisors that aided in the willful noncompliance, and, for offshore disclosures, several questions regarding contact with foreign institutions or governments.

Most importantly, Part II of Form 14457 requires a detailed narrative discussing the willful conduct, including the parties involved, the banks/institutions involved, the advisers and advice given, the specific acts of noncompliance, and other supporting facts. The instructions state that the narrative must “truthfully and in complete detail explain your noncompliance from inception to the present”.

In 2024, the IRS added a couple of important new check box items to Part II of Form 14457.

The first new checkbox in Part II requires that the taxpayer confirm that the taxpayer has “prepared and will all hold all required documents to provide to the examiner upon initial contact including, but not limited to, delinquent and/or amended returns, bank statements and financial records.” This means that taxpayers must have already engaged with a tax professional to assist with preparing amended returns and supporting documents before submitting Part II.

The second new check box requires that a taxpayer confirm that the taxpayer “was willful in the actions that led to [the taxpayer’s] tax noncompliance and understand that willfulness is a requirement to be considered for entry into the VDP.” This box requires that the taxpayer confirm that the taxpayer believes the conduct was willful. This is a significant admission by the taxpayer, which precedes acceptance in the program. The request to enter the program always carried risk of providing incriminating information before being accepted the program. This new box raises the stakes by requiring taxpayers to confirm willful noncompliance and then sign the document under penalty of perjury, stating that it is “true, correct, and complete.

After reviewing Part II, the IRS will confirm receipt and preliminary acceptance into the voluntary disclosure program. At this point, the taxpayer waits for the IRS to assign an IRS revenue agent to the case.

IRS Examination For Years in Disclosure Period

Once an IRS revenue agent is assigned, the IRS conducts a field examination of each of the years in the disclosure period. Generally, the revenue agent conducts the examination under regular IRS field examination procedures.

The revenue agent typically requests the amended returns and supporting records in the initial communication with the taxpayer or with the taxpayer’s power of attorney. For more on what to expect in an IRS examination, see What to Expect in an IRS Examination: Key Concepts & Stages in a IRS Field Examination

In an IRS field examination, the revenue agent interview the taxpayer to help gather information. A revenue agent typically likes to interview the taxpayer to “gain an understanding of the taxpayer’s overall financial picture, the business history and operations, and an overview of the taxpayer’s recordkeeping practices.” In the VDP program, the internal IRS guidance on the VDP program provides that an examiner should prepare a “Memorandum of Interview” (MOI) in order to document imposition of the civil fraud penalty and willful FBAR penalties.

Reports and Closing Agreement (Form 906)

After the Revenue Agent finishes the examination, the agent drafts a normal examination report, including Form 4549, Form 906, Closing Agreement, and FBAR Agreement. The examiner’s drafts are subject to multiple levels of review within the IRS until they are shared with the taxpayer.

Typically, the taxpayer’s amended returns were carefully prepared before entering the program. Therefore, the report (i.e., Form 4549) should generally be consistent with the amended returns provided by the taxpayer. The IRS revenue agent will usually share a draft Form 4549, which provides the taxpayer and his representative the ability to confirm the adjustments to tax match those on the amended returns.

Any adjustments to tax in the report and any related penalties are incorporated into a Form 906, Closing Agreement. Form 906, Closing Agreement is signed by both the taxpayer and by the IRS pursuant to IRC § 7121. Under that section, the agreement “shall be final and conclusive, and, except upon a showing of fraud or malfeasance, or misrepresentation of a material fact.”

Fully payment is one of the terms incorporated into the closing agreement. Unless other arrangements are made, payment of the resulting tax, penalties, and interest is expected when the Form 906 and related documents are signed and returned to the IRS.

Penalty Structure In Voluntary Disclosure Practice

The VDP is designed for taxpayers with willful noncompliance. Therefore, as a baseline, the IRS asserts fraud and willful penalties.

Generally, if a taxpayer successfully reaches the Closing Letter stage, the IRS will apply a civil fraud penalty or fraudulent failure to file penalty to the year in the disclosure period with the highest understatement. The civil fraud penalty is 75% of the understatement. Typically, no additional accuracy, fraud, or delinquency related penalties are asserted. However, interest and estimated tax payment penalties will apply to all years.

If the taxpayer’s disclosure involves FBAR noncompliance, then the IRS asserts a willful FBAR penalty in accordance with existing IRS guidelines under the Internal Revenue Manual (IRM) 4.26.16 and 4.26.17. Typically, this means that the IRS will assert a penalty equal to 50% for the year with the maximum aggregate account balance.

In addition to FBARs, some disclosures may require filing delinquent or amended international information, such as Form 3520, Form 3520-A, Form 5471, Form 5472, etc. The VPD guidelines provide the examiner with discretion in determining whether penalties related to other international information returns should be applied. Nevertheless, internal IRS guidance indicates that these penalties are intended to be used in exceptional cases. The internal guidance policy specifies that these penalties are intended to ensure consistency among similar taxpayers holding foreign assets, particularly when the disclosed foreign assets are not covered under FBAR reporting requirements.

Conclusion

Although a voluntary disclosure is a significant undertaking, it is a valuable program for taxpayers with potential criminal tax exposure. However, whether or not someone’s conduct rises to the level criminal willfulness not be a black and white. For those with non-willful conduct, there are other avenues to come into compliance. Therefore, careful and critical thought should be given to identify the best option for coming into compliance.