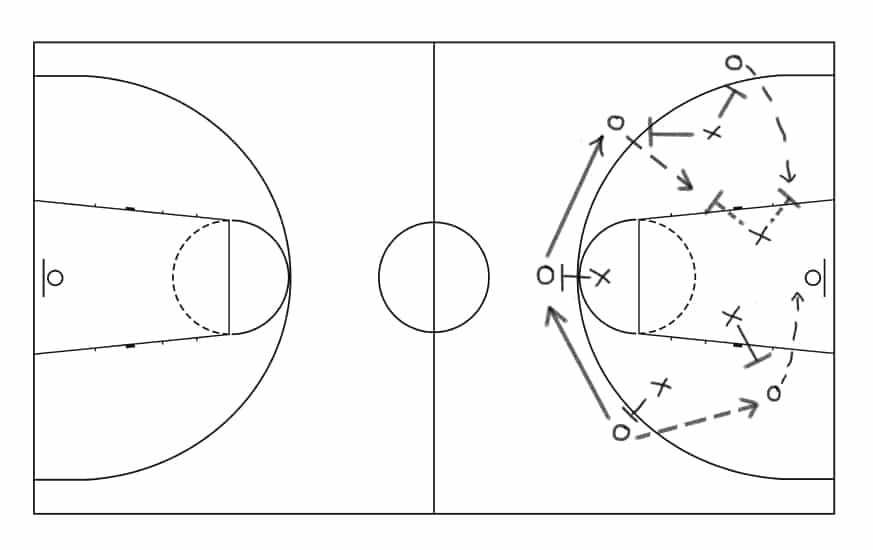

Judge Compares Nordstrom’s IP Holding Company State Tax Play to Maligned Basketball Strategy

On Monday August 18, 2014, the Maryland Court of Appeals released its decision in NIHC v. Comptroller of the Treasury.[1] The counsel for Nordstrom must have known that things were not going to go their way when the opinion’s opening paragraph analogized their client’s “intellectual property holding company” (”IPHC”) tax planning to the historically successful,…