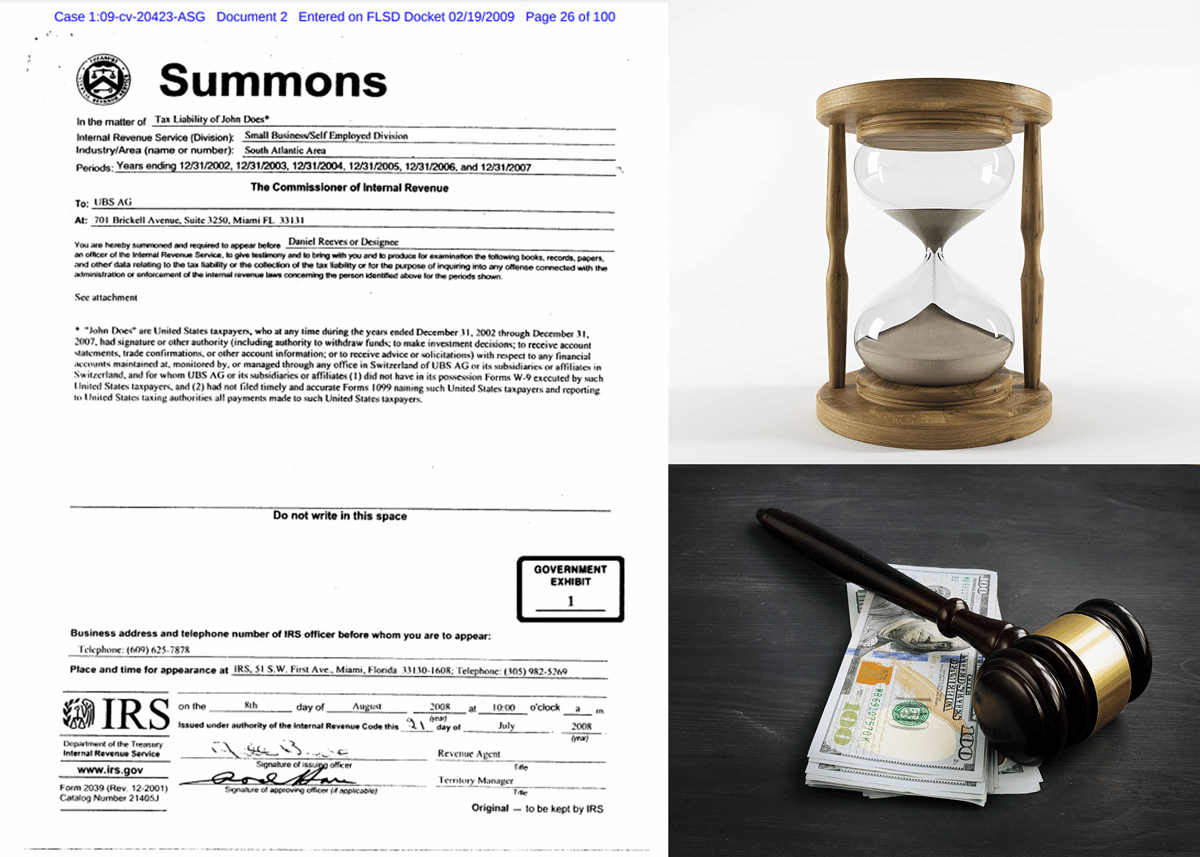

John Doe Summons Extended SOL & Prevented Amended Returns From Fending Off IRS Penalties

In Lamprecht v Commissioner, TC Memo 2022-91 (link to case), a John Doe summons tolled the statute of limitations and allowed the IRS to assess a 20% accuracy related penalty more than 6 years after the Taxpayers’ original income tax returns were filed. The IRS was able to assess the penalty even though the Taxpayer…