Tax Court Dismisses Challenge to IRS Certification of Seriously Delinquent Tax Debt As Moot

Ruesch v. Commissioner, 154 T.C. No. 13 (2020)(link to case in Google Scholar) is the first Tax Court opinion that analyzes the IRS’s ability to certify “seriously delinquent tax debts” to the US State Department for potential “denial, revocation, or limitation of a passport” under IRC § 7345. The case was dismissed because the IRS had already “decertified” the taxpayer’s debt before the case reached trial.

However, the Tax Court’s opinion has a helpful discussion of the court’s limited scope and power to review the IRS’s certification and the taxpayer’s alleged seriously delinquent tax debt. Specifically, the Tax Court concluded that it has limited jurisdiction in IRS passport revocation case to review the certification process, and the court cannot not consider a taxpayer’s challenge to an underlying tax.

The Tax Court’s only power was to order the IRS to notify the Secretary of State that such certification was erroneous. The Tax Court noted that the taxpayer had to use other procedural avenues to challenge the underlying balance.

Case Background

In Ruesch, the taxpayer did not timely file certain information reports, so the IRS assessed $160,000 of penalties against under section 6038 – Information reporting with respect to certain foreign corporations and partnerships[1]. The IRS sent the taxpayer a notice and demand for payment, but the taxpayer did not pay the liability.

When the IRS sent the taxpayer a collection Notice CP504, the taxpayer filed a Collection Action Appeal (“CAP Appeal”). The IRS however coded the CAP Appeal as a Collection Due Process (“CDP”) hearing request. However, the notice did not carry CDP hearing rights.

Several months later, the IRS sent the taxpayer Notice of Federal Tax Lien Filing and Your Right to a Hearing, which does carry CDP hearing rights. The taxpayer timely requesting a CDP Hearing by submitting Form 12153.

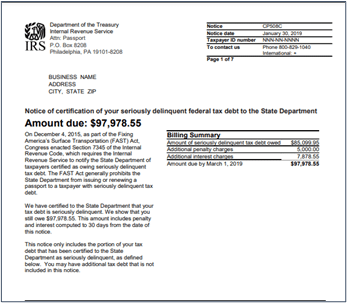

Despite the timely CDP hearing request, the IRS certified the taxpayer as owning a “seriously delinquent tax debt” to the State Department. As a result, IRS sent petitioner a Notice CP508C, Notice of Certification of Your Seriously Delinquent Federal Tax Debt to the State Department.

IRS Passport Revocation Program

IRC § 7345 provides that if the IRS certifies that a taxpayer has a “seriously delinquent tax debt” then the IRS must notify the US Secretary of State. The Secretary of State then has the authority to take action to deny, revoke, or limit the taxpayer’s passport.

A “seriously delinquent tax debt” is a federal tax liability in excess of $50,000 (adjusted for inflation; $54,000 as of the date of this post). However, there are certain statutory and administrative exceptions. One of the key exceptions is that the definition of “seriously delinquent tax debt” excludes a debt with respect to which collection is suspended because a CDP hearing has been requested or is pending. See § 7345(b)(2)(B)(i). A certification of a tax debt while a CDP hearing has been requested or is pending is a reversible error since the tax debt does not meet the definition of a seriously delinquent tax debt.

Tax Court Case and Analysis

After receiving the CP508C, the taxpayer petitioned US Tax Court seeking: (1) a redetermination of the penalties assessed against her (i.e., the assessment was illegal); (2) a determination that the IRS erred in certifying her as a person having a seriously delinquent tax debt; and (3) a determination that the IRS erred in failing to reverse his certification.

However, after the Tax Court case was initiated, the IRS discovered that the taxpayer had timely requested a collection due process (CDP) hearing. Therefore, the taxpayer’s request for a CDP hearing suspended collection of her tax debt, so that it was no longer “seriously delinquent.” See IRC § 7345(b)(2)(B)(i). The IRS accordingly reversed its certification as erroneous and so notified the Secretary of State. See sec. 7345(c)(1), (2)(D) .

In the Tax Court case, the IRS filed a motion to dismiss for lack of jurisdiction and a motion to dismiss on grounds of mootness (i.e., the IRS’s certification was already reversed). The Tax Court granted the motion to dismiss without considering the merits of the taxpayer’s substantive challenge to the underlying tax debt for the late information return filing penalties under § 6038.

Tax Court’s Scope of Review in Certification of Seriously Delinquent Tax Debt Cases

Tax Court has limited jurisdiction to hear cases in which Congress has authorized. Most Tax Court cases are heard because the Tax Court has jurisdiction (i) to hear a taxpayer’s timely petition of proposed adjustments in a statutory notice of deficiency (i.e., adjustments stemming from a CP2000 notice or after an IRS examination)[2] or (ii) to hear a taxpayer’s challenge to a settlement officer’s determination resulting from a collection due process hearing.

Section 7345(e) grants taxpayer’s limited access to judicial review.

(e)Judicial review of certification

(1)In general

After the Commissioner notifies an individual under subsection (d), the taxpayer may bring a civil action against the United States in a district court of the United States, or against the Commissioner in the Tax Court, to determine whether the certification was erroneous or whether the Commissioner has failed to reverse the certification. For purposes of the preceding sentence, the court first acquiring jurisdiction over such an action shall have sole jurisdiction.

(2)Determination

If the court determines that such certification was erroneous, then the court may order the Secretary to notify the Secretary of State that such certification was erroneous.

As the Tax Court noted, this subsection only grants narrow jurisdiction in passport cases. In such cases, the Tax Court has the authority to determine “whether the Commissioner’s certification of a taxpayer as a person having a seriously delinquent tax debt (or his failure to reverse a certification) ‘was erroneous.’” Ruesch at 11.

Therefore, practically, the Tax Court can only consider the following questions:

- Whether the taxpayer’s assessed Federal tax liability exceeds $50,000 (as adjusted for inflation);

- whether the IRS has commenced collection action with respect to that liability;

- whether collection of the tax debt is suspended because a CDP hearing is pending;

- whether the taxpayer is paying the tax debt in a timely manner under a collection alternative; or

- whether the tax debt “has been fully satisfied or has become legally unenforceable (e.g., the collection period of limitations had expired).

However, in Ruesch, the Tax Court noted that it does not have jurisdiction to consider the underlying liability in a § 7345 case (i.e., petition of CP508C – Notice of certification of your seriously delinquent federal tax debt to the State Department). This means that the Tax Court could not determine whether or not the underlying penalty should have been asserted against the taxpayer.[3]

The only relief that the Tax Court can provide is to order the IRS “to notify the Secretary of State that such certification was erroneous.”

Mootness of Taxpayer’s Challenge to the IRS’s Certification

Because the Tax Court’s jurisdiction is limited to determining if the certification is valid, the Tax Court does not have jurisdiction if the IRS decertifies a taxpayer’s debt. Therefore, when the IRS decertified the taxpayer’s debt in Ruesch, there was no live case or controversy (i.e., the Tax Court could only order the IRS to reverse the certification, which it already had). [4]

The Tax Court noted that if the IRS recertified the taxpayer’s debt after the CDP hearing, then the taxpayer is still free to petition Tax Court under § 7345.

Conclusion

The Tax Court’s jurisdiction is limited in IRS passport revocation cases because Congress only provided a limited scope of review under § 7345. The Tax Court is limited to determining whether the IRS’ certification of the debt is erroneous. Specifically, the taxpayers can challenge whether the tax debt meets the definition of “seriously delinquent tax debt” or if one of the exceptions applies (e.g., a CDP hearing is pending). However, a taxpayer’s challenge of the IRS’s certification in Tax Court under § 7345 does not provide the taxpayer the right to challenge underlying tax debts.

Notes

[1] For more on the penalties discuss in Ruesch, see IRC 6038 – link; IRM 20.1.9.3 (03-21-2013) IRC 6038—Information Reporting With Respect to Foreign Corporations and Partnerships- link.

[2] “After the IRS mails a taxpayer a timely notice of deficiency, this Court has jurisdiction to redetermine deficiencies in income, estate, and gift taxes “imposed by subtitle A or B” and deficiencies in certain excise taxes imposed by “chapter 41, 42, 43, or 44.” Secs. 6212(a), 6213(a).” See Ruesch at 13.

[3] The Section 6038 penalties assessed by the IRS are outside of the Tax Court’s normal statutory notice of deficiency jurisdiction (i.e., the IRS does not issue a notice of deficiency when it assesses penalties under § 6038). The IRS tax debts for such penalties are subject to normal collection procedures, including the issuance of final notice of intent to levy and notice of federal tax lien filing both of which carry CDP rights. In a CDP hearing, the taxpayer existence or amount of the underlying tax liability if the person did not receive any statutory notice of deficiency for such tax liability or did not otherwise have an opportunity to dispute [it]. If the taxpayer receives a negative determination in the CDP Hearing, then the taxpayer can challenge the determination in Tax Court. See for example Flume v. Commissioner T.C. Memo 2017-21, discussed here: link.

Taxpayers that no longer have the ability to challenge the underlying liability in Tax Court are left to pay the debt, seek a refund from the IRS, and then bring the case to District Court in a refund suit.

[4] In reaching its conclusion, the Tax Court rejected arguments that the case was not moot under the “voluntary cessation” doctrine.