Taxpayer Wins District Court Case on Calculation of Non-Willful FBAR Penalties

In U.S. v. Bittner [1](available here: link), the U.S. District Court for the Eastern District of Texas (the “Court”) handed taxpayers a victory by declining to follow the legal analysis in Boyd v U.S. In doing so the Court rejected the IRS’s interpretation of what constitutes a “violation” for purposes of computing non-willful FBAR penalties under 31 USC § 5321. Instead the court held that the incorrect/unfiled FinCEN 114 form (i.e., FBAR form) is the “violation” for purposes of the non-willful penalty computation rather than counting each unreported account on the FBAR as a violation.

Why is this important? Because the penalty for each non-willful violation is $10,000. Thus, if there are multiple unreported accounts in a year, then the FBAR penalty will be significantly higher. In Bittner, this meant that the taxpayer was only subject to $40,000 in non-willful penalties rather than the IRS’s proposed penalty of $1,770,000.

So far only two courts have weighed in directly on this specific issue: the U.S. District Court for the Central District of California (Ninth Circuit)(Boyd) and the U.S. District Court for the Eastern District of Texas (Fifth Circuit)(Bittner). After reviewing the exact same text in the § 5321, these two courts have reached contradictory holdings. Therefore, Bittner is a victory for taxpayers because it provides ammunition for taxpayers facing similar penalties. However, it is not binding precedent for most taxpayers.

Background

In Bittner, the taxpayer was a Romanian, who earned an engineering degree from University of Bucharest. He moved to US in 1982 and then became a U.S. Citizen in 1987 or 1988. He then moved back to Romania in 1990 and lived there until 2011.

The Taxpayer was very successful in business and generated over $70 million in income through his various foreign businesses and investment ventures.

When Mr. Bittner left the U.S., he did not renounce citizenship. As a result, he was still a “U.S. person” with U.S. tax and information reporting obligations. However, he only filed a handful of U.S. tax returns while living in Romania, and he did not file any foreign bank accounts prior to 2011.

Mr. Bittner had an interest in a number of foreign financial accounts in his individual name and indirectly through his various business interests. His aggregate interest in foreign bank accounts surpassed the $10,000 threshold for reporting.

After returning to the United States in 2011, Mr. Bittner engaged a CPA to prepare late tax returns and to report his foreign bank accounts. Mr. Bittner took a position, on his late filed U.S. Federal income tax returns that significant amounts of his income was excludible under the U.S.-Romania tax treaty. On the late FBARs for years 2006, 2007, 2008, and 2009, Mr. Bittner’s CPA reported a handful of the foreign bank accounts, while omitting a significant number of other accounts, based upon the CPA’s mistaken impression that Mr. Bittner only had to report the account with the high balance in the year.[2]

The IRS responded by rejecting the tax treaty position and asserting that Mr. Bittner owed approximately $6 million in tax, penalties, and interest.[3] After realizing that the original returns contained potential material errors, Mr. Bittner engaged a new CPA. In September 2013, Mr. Bittner, with the assistance of the second CPA, amended his tax returns for 2006-2011, which took almost 9 months to complete due to their complexity.[4]

The amended returns showed that, after claiming foreign tax credits, Mr. Bittner he only owed an additional $326 (not the approximately $6,000,000 claimed by the IRS). In additional, Mr. Bittner filed amended FBARs for 2006-2010. The new CPA also helped the taxpayer file a corrected FBAR and checked the box that he held a financial interest in 25 or more foreign accounts, including personal accounts and accounts which eh owned more than 50% of.

Subsequently, the IRS issued Mr. Bittner a statutory notice of deficiency, which he challenged in Tax Court. Ultimately the IRS and Mr. Bittner settled the case. The Tax Court settlement stated that there were no deficiencies for 2008, 2009, and 2010 and that he owed approximately $46,385.88 for 2007 and $127,000 for 2011, which Mr. Bittner paid.

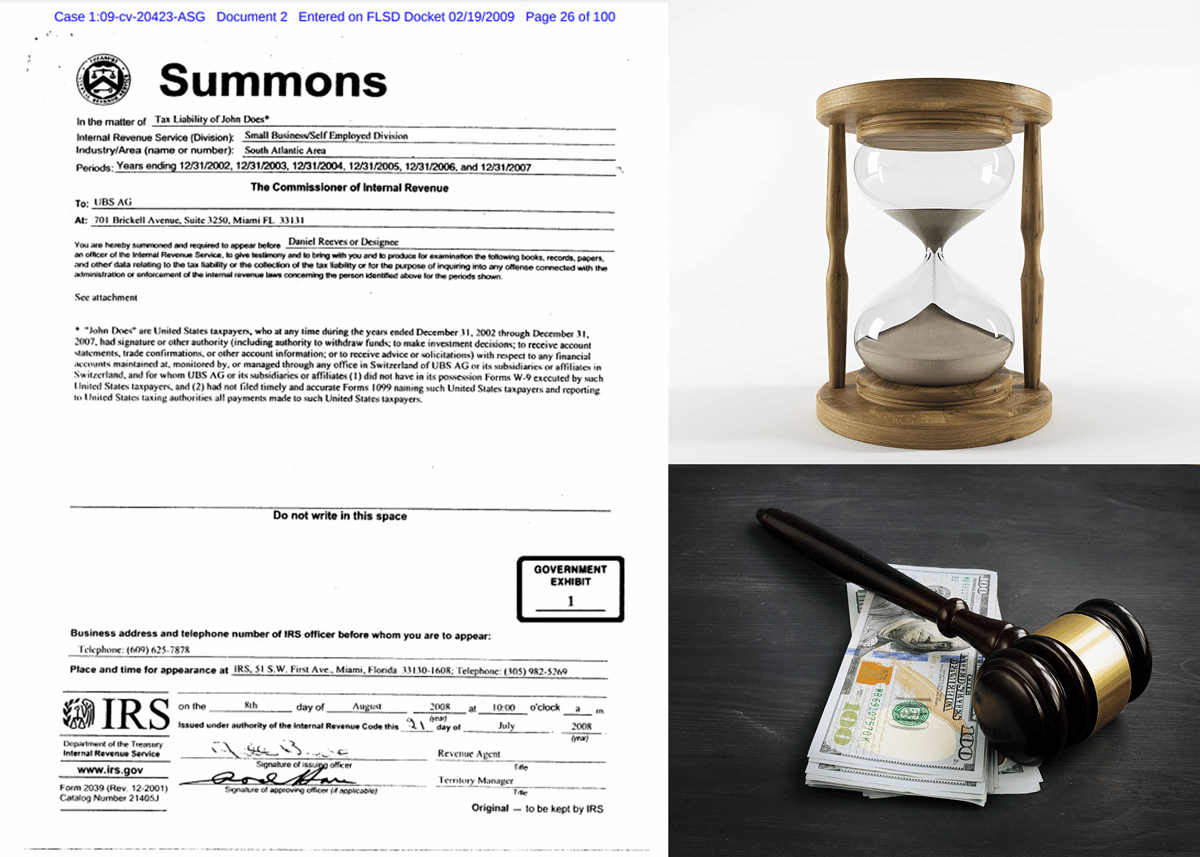

In June 2017, the IRS assessed Mr. Bittner non-willful penalties of $2,720,000 ($10,000 per account that was not accurately reported on the original FBAR). Then, in June 2019, the IRS brought a civil action in Federal District Court for the Eastern District of Texas to reduce the assessed non-willful FBAR penalties to judgment, so that they could collect on the assessment.

The United States and Mr. Bittner each filed motions for summary judgment, which lead to the opinion on June 29, 2020. In the motion for summary judgment, the government only sought $1,770,000 in penalties, computed on the basis of the number of accounts that the taxpayer admitted to, rather than the full $2,720,000 assessed by the IRS.

Overview of the Issue

The issue in Bittner is what constitutes a violation for purposes of computing the non-willful FBAR penalty under 31 USC §§ 5321, 5314 and the regulations implementing § 5314. More specifically:

“about whether an FBAR reporting deficiency constitutes a single violation, or whether each foreign financial account not properly or timely reported on an FBAR constitutes a separate reporting violation. In other words,…whether the number of “violations” that occur when an account holder commits an FBAR reporting deficiency varies with the number of accounts maintained by that account holder that were not properly reported.”

Background Law

The Bank Secrecy Act of 1970 (as amended) (“BSA”) imposed record retention and reporting requirements for U.S. persons that transact or maintain a relation for any person with a foreign financial agency. See 31 USC § 5314.

Section 5314 of the BSA directs the Secretary of the Treasury to require U.S. persons (i.e., residents and citizens) to file reports when they maintain foreign and/or offshore bank accounts. Generally, these reports must contain the following information:

(1) the identity and address of participants in a transaction or relationship.

(2) the legal capacity in which a participant is acting.

(3) the identity of real parties in interest.

(4) a description of the transaction. 31 U.S.C. § 5314(a)(1)–(4).[5]

FinCEN form 114, widely known as an FBAR (Foreign Bank Account Report), is the form used to collect this information.

Under authority granted in § 5314, the Secretary of the Treasury has also issued regulations (31 C.F.R. §§ 1010.350(a), § 1010.306), which provides further detail and guidance on the foreign bank account reporting requirements imposed by the BSA.

In addition, 31 USC §§ 5321, 5322 provide for civil and criminal sanctions for violations of the foreign bank account reporting requirements. As stated above, the interpretative issue presented in the Bittner case was what constitutes a “violation” for purposes of § 5321.

Specifically, the civil penalty provisions in § 5321 provides:

(5) Foreign financial agency transaction violation.—

(A) Penalty authorized.—The Secretary of the Treasury may impose a civil money penalty on any person who violates, or causes any violation of, any provision of section 5314.

(B) Amount of penalty.—

(i) In general.—Except as provided in subparagraph (C), the amount of any civil penalty imposed under subparagraph (A) shall not exceed $10,000.

(ii) Reasonable cause exception.—No penalty shall be imposed under subparagraph (A) with respect to any violation if—

(I) such violation was due to reasonable cause, and

(II)the amount of the transaction or the balance in the account at the time of the transaction was properly reported.

(C) Willful violations.—In the case of any person willfully violating, or willfully causing any violation of, any provision of section 5314—

(i) the maximum penalty under subparagraph (B)(i) shall be increased to the greater of—

(I) $100,000, or

(II)50 percent of the amount determined under subparagraph (D), and

(ii) subparagraph (B)(ii) shall not apply.

(D) Amount.—The amount determined under this subparagraph is—

(i) in the case of a violation involving a transaction, the amount of the transaction, or

(ii) in the case of a violation involving a failure to report the existence of an account or any identifying information required to be provided with respect to an account, the balance in the account at the time of the violation.

Arguments

IRS

The IRS argued that each failure to report a bank account on a FBAR constitutes a “violation” and each violation can support a penalty of up to $10,000. Congress granted the Secretary of the Treasury the discretion to impose FBAR penalty and the amount of that penalty up to the statutory cap (i.e., $10,000 for non-willful violations).

Although each penalty can support a separate $10,000 penalty, the IRS uses discretion in applying the penalty. In order to provide some consistency across the IRS, the IRS implemented Internal Revenue Manual (“IRM”) provisions providing how the non-willful penalty is supposed to be asserted by Revenue Agents. See 4.26.16.6.4.1 (11-06-2015) Penalty for Nonwillful Violations – Calculation.[6]

Under the IRS’s interpretation, Mr. Bittner incurred 177 violations during the relevant 4 years at issue in the case. The total potential penalty: $1,770,000.

Taxpayer

Mr. Bittner argued that the deficiency is the failure to file an accurate/complete FBAR (i.e., the form) and thus the failure to file an accurate/complete FBAR constitutes a single violation. Under Mr. Bittner’s interpretation, each omitted bank account does not constitute a separate violation.

Prior precedent

There was one court that squarely confronted the same interpretative question. In Boyd v. US., the District Court for the Central District of California held that “[i]n light of the prominence of ‘transactions’ and ‘accounts’ in the language of section 5321, the court determines that the statute contemplates that the relationship with each foreign account constitutes the non-willful FBAR violation.” [Emphasis added] [7]

The Boyd case is currently on appeal to the Ninth Circuit. Oral arguments are currently set for September 1, 2020.

Court’s Holdings

FBAR Violation is Per Form, Not Per Account

In Bittner, the Court read the same statutory language and reached the exact opposite conclusion as the court did in Boyd. In its analysis, the Court in Bittner placed a great deal of emphasis on the fact that Congress utilized the words “account” and “accounts” over one hundred times in the BSA, yet Congress did not use the words “account” or “accounts” in the non-willful penalty subsections (5321(a)(5)(A) and (B)(i))), which were added in 2004. Therefore, the Court reasoned that if Congress had wanted to penalize each missing account that it would have so specified by using the terms “account” or “accounts” as it had throughout the rest of the BSA. As a result, the Court concluded that the non-willful FBAR penalty applies on a per form basis, rather than on a per account basis.

No Reasonable Cause For Ignorance of Law

Although they were not the focal point of the opinion, the Court did discuss several other arguments that the taxpayer made, including reasonable cause argument.[8]

Under the reasonable cause exception, an individual who commits a non-willful FBAR violation is not assessed a civil penalty if that violation was due to reasonable cause.[9]

Reasonable cause is not defined in BSA. Courts analyzing reasonable cause have looked to other tax related code provision using reasonable cause for a definition. [10] To demonstrate reasonable cause under the related case law, an individual must show that he “exercised ordinary business care and prudence.”

The taxpayer’s position was that he did not know about his obligation to file FBARs and also on the FBAR reports that he did file were as the result of bad advice from his CPA. Based upon his reliance on the CPA, the taxpayer believed that he qualified for the reasonable cause exception.

The Court believed that Mr. Bittner was a sophisticated, intelligent business and he was aware of some of his income tax filing obligations. The Court stated the taxpayer “cannot claim with a straight face that, as an American citizen generating millions of dollars in income abroad, he was so unaware that he might have United States reporting obligations that he did not even feel compelled to investigate the matter.” Therefore, the taxpayer’s argument that his ignorance of his FBAR filing obligations was no defense to his untimely filing of his FBARs. As a result, even there were errors on his late filed FBARs due to his CPA’s erroneous advice, the taxpayer did not exercise ordinary business care and prudence because he failed to investigate his obligations in a timely manner. Therefore, the Court held that the taxpayer had not demonstrated reasonable cause.

Conclusion

The Court’s interpretation of what constitutes an FBAR “violation” in the Bittner opinion is a win for taxpayers facing non-willful FBAR penalties. However, given that there is a split among district courts and the Boyd case is still on appeal to the Ninth Circuit, the issue is far from settled. In the meantime, taxpayers that face non-willful penalties will face an uphill battle until the IRS either changes its policy in applying non-willful FBAR penalties or it becomes clear that the courts will provide a consistent pro-taxpayer interpretation that each account that is not properly reported on an FBAR does not constitute a separate “violation” under § 5321.

Notes:

[1]U.S. v. Bittner, 4:19-cv-00415, ECR 75 (E.D. Tex. June 29, 2020)

[2] Bittner v. U.S., 19-cv-00415-ALM, Answer ¶ 48.

[3] Bittner v. U.S., 19-cv-00415-ALM, ECR #28 at page 5.

[4] Bittner v. U.S., 19-cv-00415-ALM, ECR #28 at page 5.

[5] The Secretary of the Treasury also has authority to require additional detail that is deemed necessary to carry out the provisions and purpose of § 5314 and the regulations promulgated thereunder. See 31 USC 5314(b).

[6] IRS Internal Revenue Manual 4.26.16.6.4.1 (11-06-2015) (link to IRM)

Penalty for Nonwillful Violations – Calculation

- After May 12, 2015, in most cases, examiners will recommend one penalty per open year, regardless of the number of unreported foreign accounts. The penalty for each year is limited to $10,000. Examiners should still use the mitigation guidelines and their discretion in each case to determine whether a lesser penalty amount is appropriate.

- For multiple years with nonwillful violations, examiners may determine that asserting nonwillful penalties for each year is not warranted. In those cases, examiners, with the group manager’s approval after consultation with an Operating Division FBAR Coordinator, may assert a single penalty, not to exceed $10,000, for one year only.

- For other cases, the facts and circumstances (considering the conduct of the person required to file and the aggregate balance of the unreported foreign financial accounts) may indicate that asserting a separate nonwillful penalty for each unreported foreign financial account, and for each year, is warranted. In those cases, examiners, with the group manager’s approval after consultation with an Operating Division FBAR Coordinator, may assert a separate penalty for each account and for each year. The examiner’s workpapers must support such a penalty determination and document the group manager’s approval.

- In no event will the total amount of the penalties for nonwillful violations exceed 50 percent of the highest aggregate balance of all unreported foreign financial accounts for the years under examination.

[7]Boyd v. United States, 2019 WL 1976472, at 8 (C.D. Cal. Apr. 23, 2019), on appeal (9th Cir. No. 19-55585). Oral arguments are currently set for September 1, 2020.

[8] The taxpayer also argued, unsuccessfully, that: (i) the penalties assessed him by the IRS for his numerous non-willful FBAR violations constitute an “excessive fine” in violation of the Eighth Amendment to the United States Constitution; (ii) that the rule of lenity, a principle of statutory construction, dictates that any ambiguities in the statute should be resolved in his favor; and (iii) that he should not be subject to non-willful penalties because he has reasonable cause. The Court held against the taxpayer in each instance.

[9] 31 USC § 5321(a)(5)(B)(ii). Technically, the amount omitted or incorrectly reported is deemed to properly reported.

[10] See IRC §§ 6664, 6677(d), and 6651(a)(1). For a discussion of reasonable cause see the post Tax Court Rejects Taxpayer’s Reasonable Cause Argument Regarding Automatic Penalties from Failure to File Forms 5471