You Received an IRS LT11, Final Notice of Intent to Levy. What’s Next?

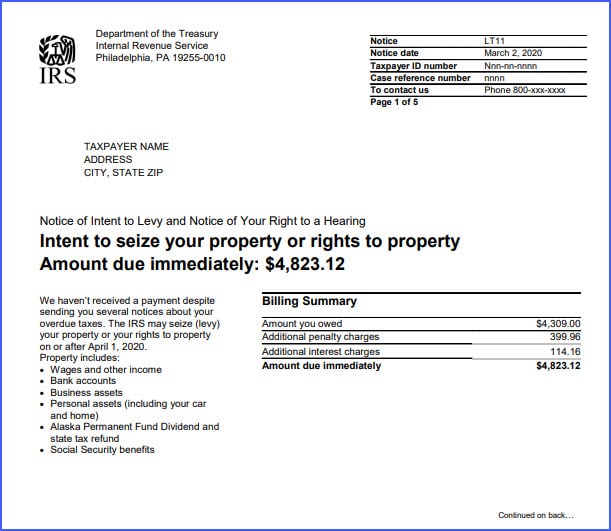

Receiving an LT11 (or a Letter 1058) Final Notice of Intent to Levy from the IRS can be overwhelming, especially when it arrives unexpectedly. This notice is a critical warning that the IRS intends to levy your assets if the outstanding tax liability is not addressed promptly. A levy is the IRS’s legal authority to seize your assets, such as bank accounts or wages, to settle unpaid federal tax debts.

However, you have the ability to take action to prevent the levy. Therefore, it is important to understand what the LT11 means, what your rights are, and how you can navigate this situation effectively.

Most importantly, the LT11 carries the right to request a collection due process (“CDP”) hearing, which is crucial. A CDP hearing gives you the opportunity to challenge the proposed levy and explore collection alternatives before the IRS levies your assets. However, this hearing is not automatic. You must request a hearing, in writing, within 30 days from the date of the LT11 notice.

This post is not a substitute for professional advice. Nevertheless, this post is aimed at providing you with some background information and context before acting on the notice.

LT11’s Place in IRS Notice Cycle

IRS tax debts can arise in various ways. Most commonly, they occur when you file a tax return but fail to pay the full amount owed. Additionally, tax debts can result from IRS audits, where discrepancies or errors in filed returns lead to the assessment of additional taxes. In any of these cases, the official act of placing the debt in the IRS’s ledger to begin the collection cycle is called an assessment

Generally, once a tax debt has been assessed, the IRS will send you notice and demand for payment. There are several different types, but they all serve the same purpose: to make the required legal notice and demand for payment, which is the first step in the notice cycle leading to an IRS levy. See examples of CP14 here, CP161 here, and CP22E here.

After receiving the notice and demand, the IRS will typically send several different reminder notices: CP501, CP503; and CP504. The first two are reminders that a tax debt is owed to the IRS. The CP504 is a threat to levy, but it does not carry CDP hearing rights.

After these notices, then the IRS will issue the final notice of intent to levy, LT11 or Letter 1058. Therefore, once you receive the final notice of intent to levy, you should have received ample warning that a tax debt was due.

Purpose and Content In LT11, Final Notice of Intent to Levy

The Internal Revenue Code (“IRC”) provides the IRS with two very powerful tools to collect federal tax debts. These tools are (i) the federal tax lien;[1] and (ii) authority to levy taxpayer’s assets. LT11 and this post focus on the IRS’s levy authority.

A levy is the IRS’s legal authority to seize your assets, such as bank accounts or wages, to settle unpaid federal tax debts. However, before the IRS can exercise this power, IRC § 6331 requires that the IRS must provide the taxpayer notice of the IRS’s intent to levy the taxpayer’s assets to collect on a federal tax debt.

This notice is typically provided on one of two forms: LT11 or Letter 1058.

Both are intended to fulfill the same statutory requirement in § 6331, so that the IRS can levy your assets. Both provide similar information, warnings, and notices, including the notice of the right to request a CDP hearing.

The IRS may effect delivery of a pre-levy CDP Notice (and accompanying materials) in one of three ways: (A) by delivering the notice personally to the taxpayer; (B) by leaving the notice at the taxpayer’s dwelling or usual place of business; or (C) by mailing the notice to the taxpayer at the taxpayer’s last known address by certified or registered mail, return receipt requested.

The final notice of intent to levy is typically sent via certified mail. Refusing to sign for the certified mail does not prevent it from fulfilling the statutory requirement that the IRS provide you notice, so long as it was sent to your last known address.

CDP Hearing Rights

LT11, Final Notice of Intent to levy (and its cousin Letter 1058, Final Notice of Intent Levy) provides the taxpayer with 30 days to request a collection due process (“CDP”) hearing. CDP hearings were added in 1998 to provide “protections in dealing with the IRS that are similar to those they would have in dealing with any other creditor.”[2] The final notice of intent to levy and the CDP hearing is meant to afford a taxpayer with “adequate notice of collection activity and a meaningful hearing before the IRS deprives them of their property.”

A CDP Hearing is requested on Form 12153, Request for a Collection Due Process or Equivalent Hearing. The form must be completed and returned to the IRS within 30 days from the date of the notice carrying the CDP hearing rights (i.e., the LT11, Letter 1058, or notice of federal tax lien filing).

The CDP hearing is powerful because, once the hearing is requested, the IRS cannot levy the taxpayer with respect to the period or periods on the notice.

However, if you owe the IRS for multiple periods, the CDP hearing does not preclude the IRS from levying on another period for which the IRS has provided the statutory notice and the CDP hearing rights have lapsed (i.e., the 30 days to request a hearing have lapsed or the CDP hearing has already been held).

There is one downside to note: the statute of limitations on collecting the debt is tolled (i.e., paused) since the IRS is precluded from collecting on the tax period or periods at issue in the CDP hearing.

Negotiating A Collection Alternative In CDP Hearing

During the CDP hearing, you have the opportunity to discuss collection alternatives based upon your ability to pay. This includes the possibility of being placed into currently not collectible status, entering into an installment agreement, or agreeing to an offer in compromise (doubt as to collectability). To explore these options, you must submit Form 433-A, Collection Information Statement, along with the necessary supporting documents, as this form helps the IRS evaluate your ability to pay. The IRS utilizes its “Financial Analysis Handbook” when reviewing the taxpayer’s financial information. See IRM 5.15.1 – Financial Analysis Handbook

If the IRS and the taxpayer cannot reach a mutually agreed upon collection alternative, then the IRS settlement officer conducing the hearing will issue a notice of determination.

A taxpayer can challenge the notice of determination in U.S. Tax Court. However, the Tax Court reviews applies a deferential “abuse of discretion” standard. In reviewing for abuse of discretion the Tax Court will uphold IRS Appeals’ determination unless it is arbitrary, capricious, or without sound basis in fact or law. The Tax Court will not substitute its judgment for that of IRS Appeals settlement officer. Instead the Tax Court will consider whether, in the course of making its determination, the IRS Appeals Office complied with the legal requirements of an administrative hearing.

Potential to Dispute Liability in CDP Hearing

In a CDP hearing, the taxpayer may also raise challenges to the existence or amount of the underlying tax liability for any tax period if the person did not receive any statutory notice of deficiency for such tax liability or did not otherwise have an opportunity to dispute such tax liability. A prior conference with Appeals, offered before or after assessment, is an “opportunity” to dispute the underlying liability.

If the taxpayer has received a notice of deficiency or had a prior opportunity to dispute the liability, then the taxpayer cannot challenge the underlying liability in the CDP hearing.

Failure to Respond

If you receive an final notice of intent to levy and do not request a hearing by the deadline, then the IRS has the authority to levy your assets to satisfy the liability.

At this point, a levy is not necessarily imminent, but you are the mercy of the IRS.

There are two different types fo IRS levies:

- One time levy (i.e., bank account, accounts receivable)

- Continuous Levy (i.e., wage garnishment)

A one-time levy takes only what is in the taxpayer’s account at the time that the levy is received by the institution/vendor. Typically, the recipient has 21 days to turn over the assets in its possession to the IRS. During this period, it is possible to receive a full or partial release of the levy by showing that the levy will create an “economic hardship”.

A continuous levy, such as a wage garnishment, will result in the recipient (i.e., the taxpayer’s employer) turning over a portion of each payment until the tax debt is satisfied or the IRS otherwise withdraws the levy.

Therefore, if the taxpayer fails to respond to the final notice of intent to levy, the next best option is to proactively approach the IRS to negotiate a collection alternative. The collection alternative will be based upon the taxpayer’s ability to pay.

Equivalent hearing

Even if you miss the 30-day deadline to request a CDP hearing, you can request an equivalent hearing within one year from the date of the notice with CDP hearing rights. The request is made on the same form: Form 12153, Request for a Collection Due Process or Equivalent Hearing.

Like the CDP hearing, IRS Appeals conducts the equivalent hearing. Similarly, the taxpayer can negotiate a collection alternative and challenge the underlying balance if the taxpayer has not had a prior opportunity to dispute the tax.

However, unlike a CDP hearing, the IRS is not precluded from levying while the equivalent hearing is pending. This also means that the statute of limitations on collections is not tolled (i.e. paused) during the pendency of the equivalent hearing.

In addition, the taxpayer cannot challenge the Appeals determination from an equivalent hearing in U.S. Tax Court.

How can a tax professional help:

If you receive an LT11, Final Notice of Intent to Levy (or Letter 1058, Final Notice of Intent to Levy), a tax professional can help you in a number of ways, including:

- Review and explain the notice;

- Obtain IRS transcripts to gain a comprehensive understanding of the situation, including balances on other tax periods;

- Ascertain if there is an ability to challenge all or portion of the balance;

- Review ability to pay under IRS financial analysis standards;

- Develop a comprehensive strategy to engage with IRS & state taxing authority;

- Advocate on your behalf for viable collection alternative

[1] For more on notice of federal tax lien filings, see IRS Lien Relief.

[2] S. Rep. No. 105-174, at 67 (1998).